Instant Online Diminshed Value Appraisals

Wondering how much your car lost in value? Please click the button below and receive an instant diminished value quote.

Recover Your Losses With a Diminished Value Claim

When your vehicle is damaged in an accident, and repairs can’t fully restore its pre-accident condition, it incurs “Diminished value.” In many states, you can file a claim with the at-fault driver’s insurance company to be compensated for this loss in value.

do i qualify for diminished value?

Disqualifying circumstances can prevent you from making a Diminished Value claim for your car in any part of the United States:

Age & Mileage

You have a vehicle that is more than 10 years old and has excessive mileage (+ 30K miles per year).

Car Market Value

Your vehicle does not have a substantial market value (cars under $7,000).

Minimal Damage

The accident caused minimal damage (usually under $500).

Vehicle History

If your vehicle has a branded title, a history of multiple severe accidents, or if you've already signed a release of liability form.

How We Can Help You Settle for More

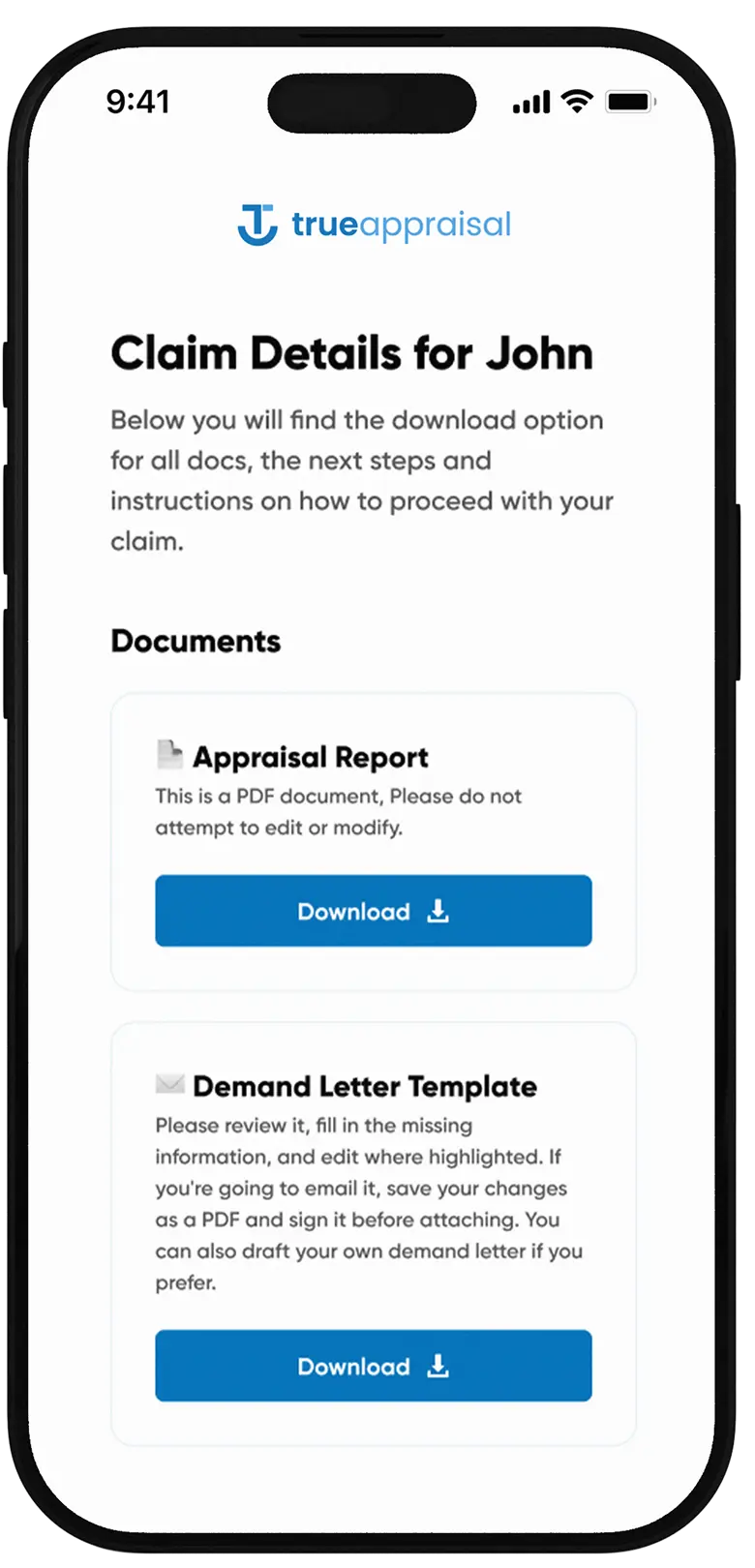

Here’s everything we provide to ensure a smooth and successful diminished value claim process.

Certified Appraisal Report

Vehicle History Report

The Diminished Value Amount

Supporting Documents

Demand Letter

Guidance From our Experts

Why Trust Us

After an accident, your car loses market value, even if fully repaired. Insurers lowball this loss 90% of the time.

Our patent-pending methodology accurately calculates the true diminished value of your car and generates an instant, fully documented online appraisal report.

Armed with this concrete evidence, you can demand the full compensation you’re legally entitled to—backed by over 30 years of experience delivering accurate, fast, and unbiased vehicle valuations tailored to your needs. Insurers are legally obligated to consider our documented reports.

Some of Our Recent Results

Our detailed appraisals have resulted in insurance payouts averaging 500% higher than initial offers.

2021 Ford Mustang Mach 1

- Prior Accident: Severe

- Gray

- Insurance offer: $1.300

- California

trusted car appraisal company

See why hundreds of people from 50+ states choose to work with us.

Frequently Asked Questions

Explore common queries about DV claims and getting the most from your compensation. Get the information you need to make informed decisions.

A diminished value settlement typically ranges between 10% and 25% of the fair market value of the vehicle, depending on a variety of factors. To calculate your DV, click here.

You are not required to accept the valuation of the insurance company.

Despite the fact that many individuals tend to agree and may potentially lose out on rightful compensation, most insurance companies calculate Diminished Value using the 17c formula.

In spite of its shortcomings, the 17c formula allows adjusters to adjust certain compensation amounts based on the specific situation.

If you use our proven claim process and the insurance company does not pay at least the appraisal cost, we will gladly refund 100% of the appraisal cost.

Typically, loss in value claims are resolved within two to six weeks. However, some may be settled even sooner. It can be beneficial to regularly check in with the insurance company to expedite the process.

If you find that your claim is being delayed and the insurance company is uncooperative, you may consider filing a complaint with the department of insurance in your state. This step can hold them accountable and prompt a response regarding your claim.