Simple, One-Time Payment

Whether you need a Diminished Value or Total Loss appraisal, you’ll pay just once — and receive your detailed report instantly.

No hidden fees. No surprises. Simple, fast, and transparent.

from 500+ reviews

Appraisal Report

Get the money you deserve from the insurance Co.

$275/Flat rate

- USPAP Compliant Valuation Report

- Demand Letter Tailored To Your Claim

- Supporting Documents

- Follow Up Letters

- Negotiating Points

- Email Support

- Phone Support

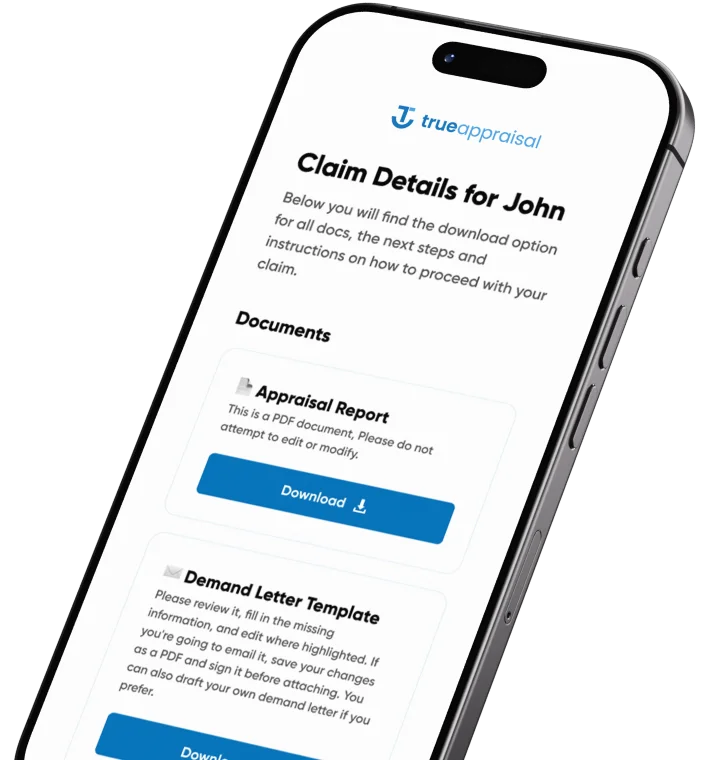

Dashboard

Here’s What You Get

With your purchase, you’ll get access to a personalized claim dashboard that includes everything you need to move forward confidently. This includes your official appraisal report, all claim details, a demand letter template, and easy-to-follow guidance.

You’ll also have support if you need help responding to the insurance company. We make it simple, organized, and ready to use — so you can focus on getting the compensation you deserve.

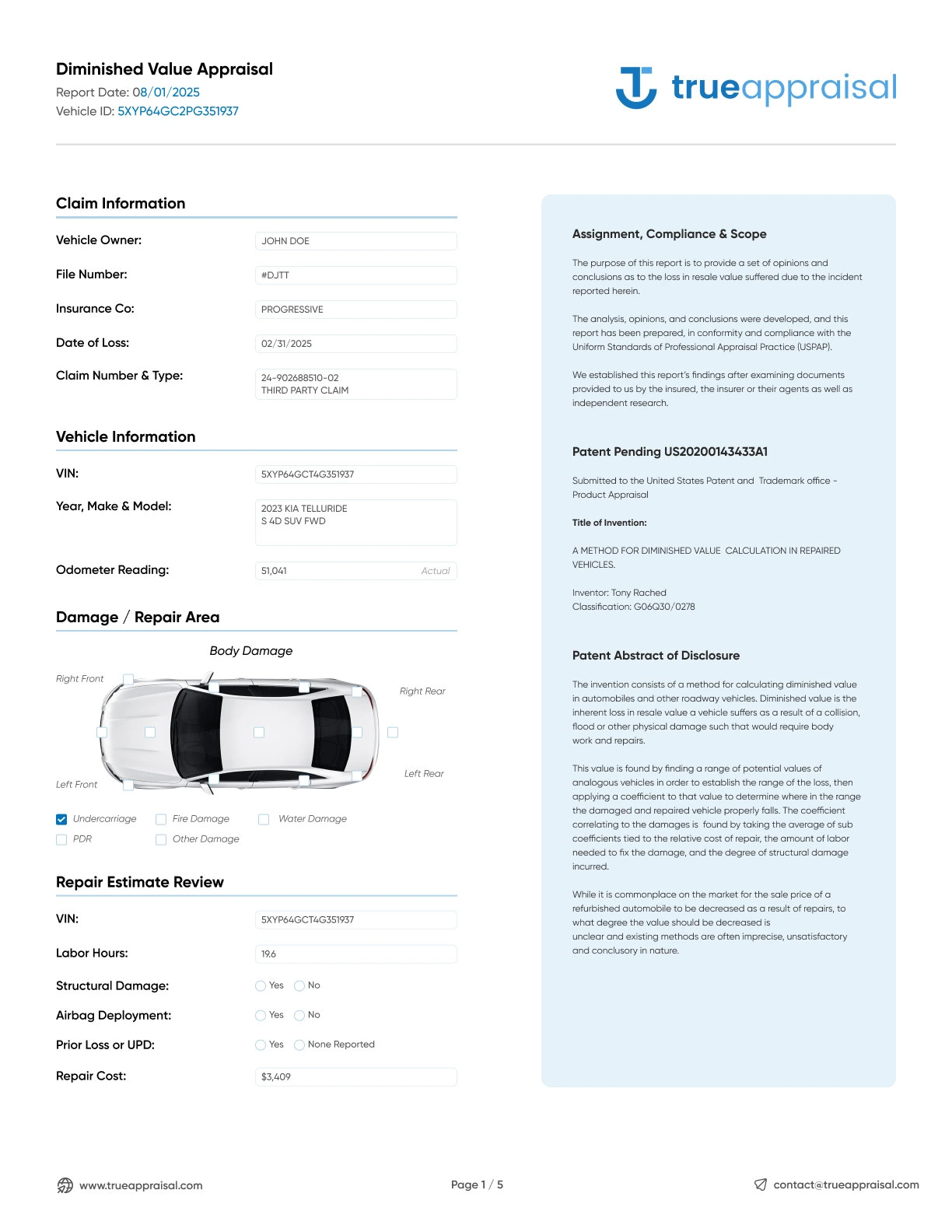

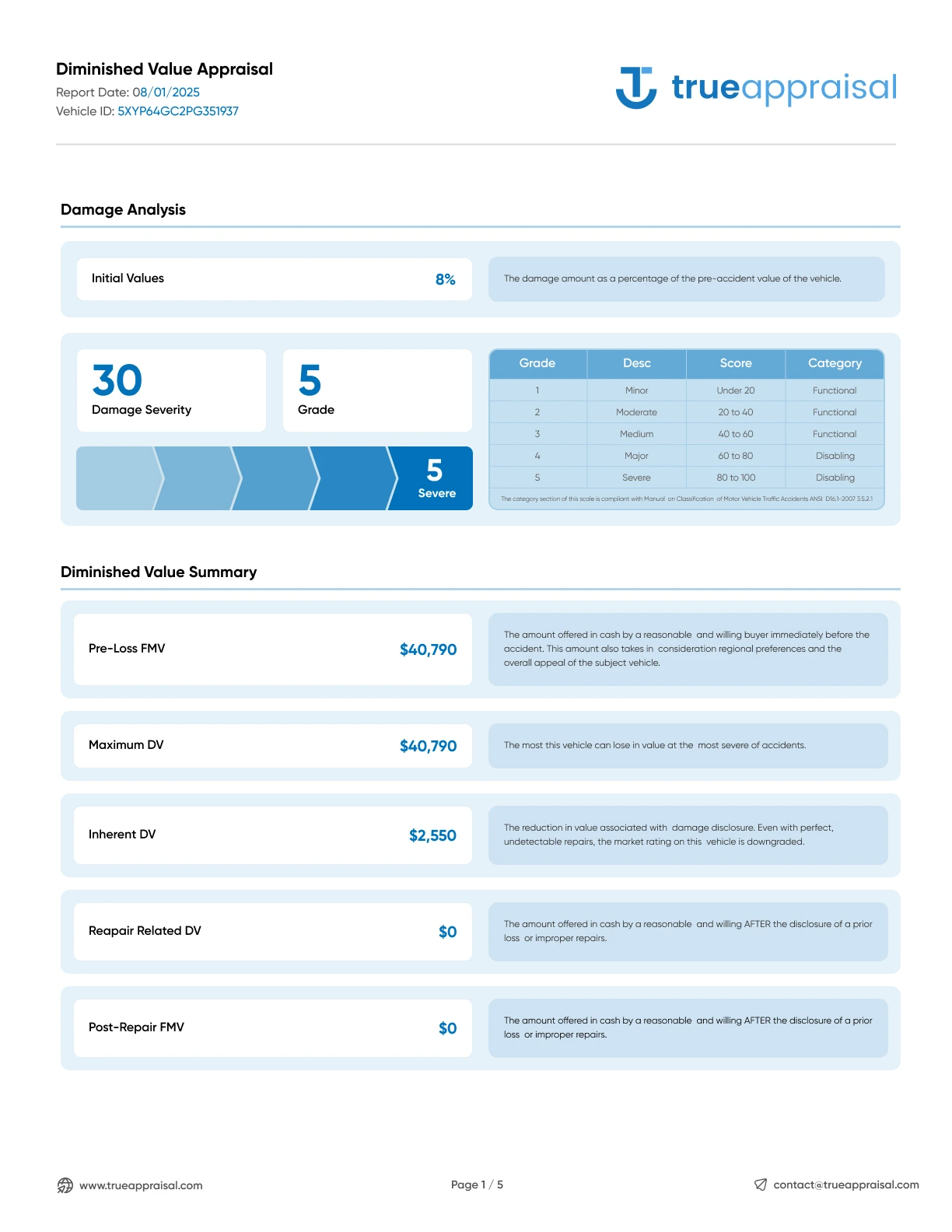

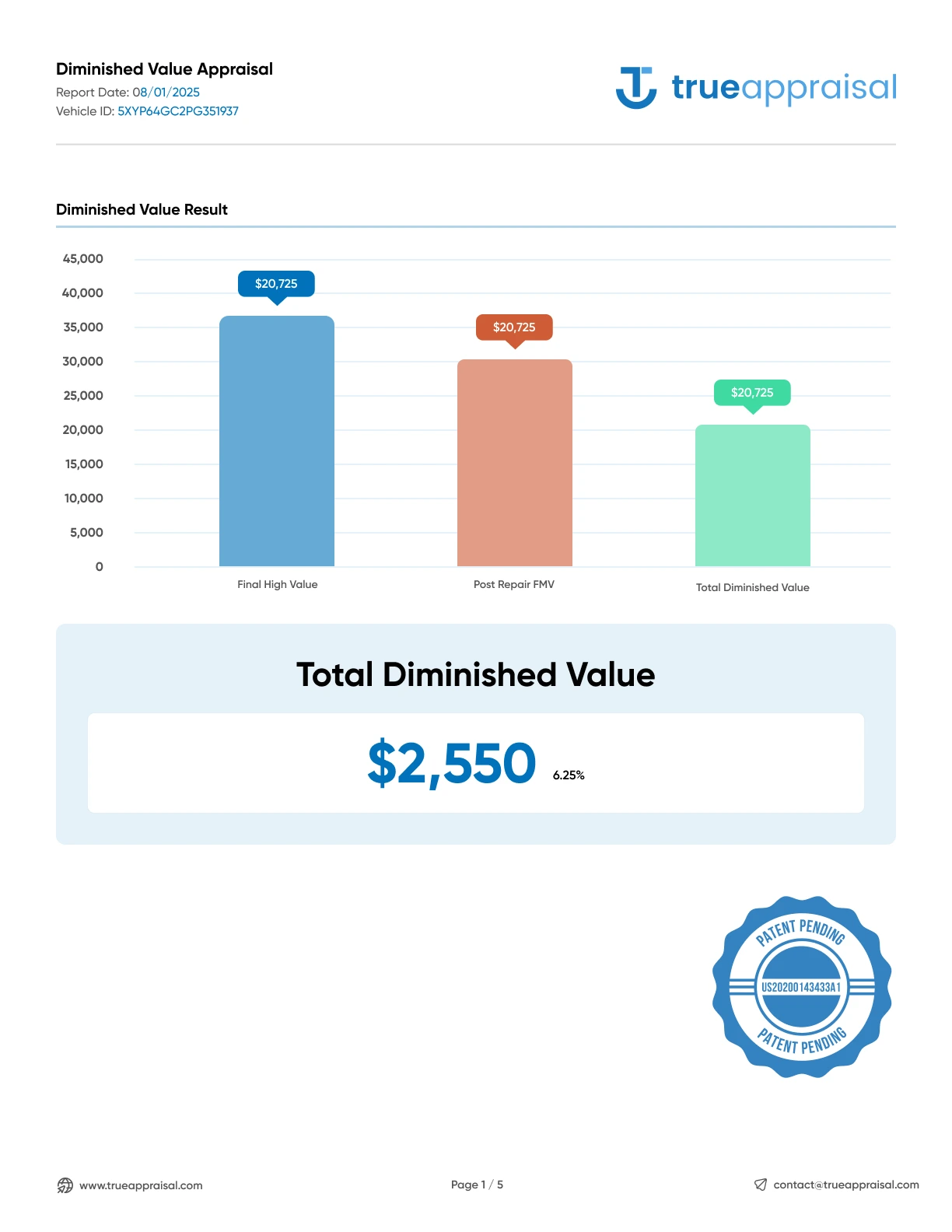

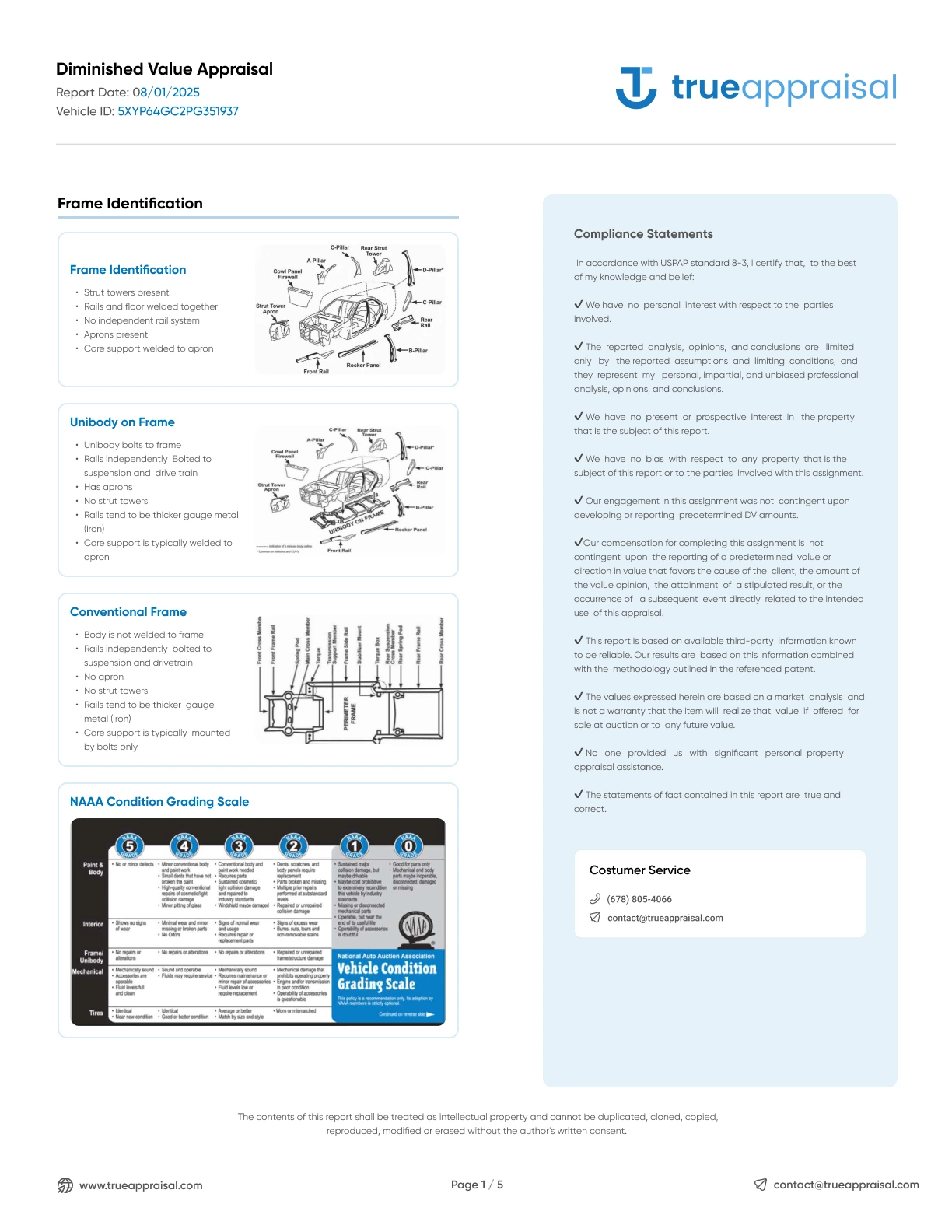

Our Report

Here’s the Report You’ll Receive

This is the exact format of the report you’ll receive — professional, detailed, and ready to submit to the insurance company.

FAQs

Frequently Asked Questions

Below are some of the most common questions we receive about the appraisal process, what’s included, and how to move forward with your claim.

It depends on the type of the appraisal:

- Diminished Value Appraisal – You will receive an instant report after you pay.

- Total Loss Appraisal – After payment, you will receive the appraisal report within 24 hours.

Yes. Insurance companies are legally required to consider a valid proof of loss, and our USPAP compliant appraisal reports serve exactly that purpose.

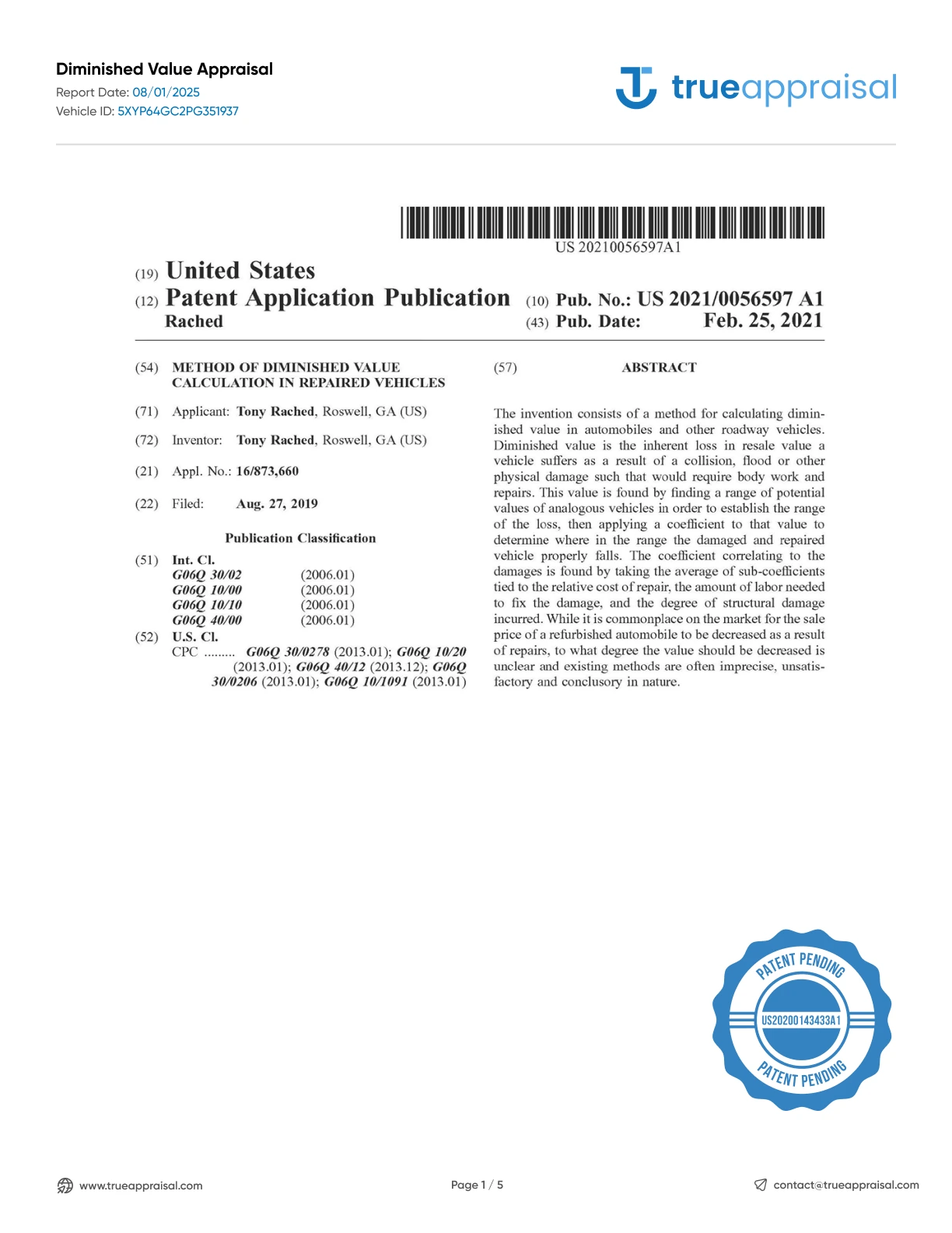

Our valuations use a proprietary, patent-pending methodology, providing a thorough assessment distinct from formulas like 17c that insurers might use.

Our service is designed to support you through the claims process. Included with your $75 flat-rate report are a tailored demand letter, supporting documents, follow-up letter templates, and key negotiating points.

We also provide email and phone support to guide you on how to proceed if the insurer is unresponsive or challenges the valuation.

We specialize in Diminished Value Appraisals and Total Loss Appraisals. If you’re dealing with a unique situation or aren’t sure which appraisal fits your needs, we invite you to contact one of our expert appraisers for a free claim review.

Absolutely! Your $75 flat-rate service includes both email and phone support. We are available to answer your questions and help guide you every step of the way.